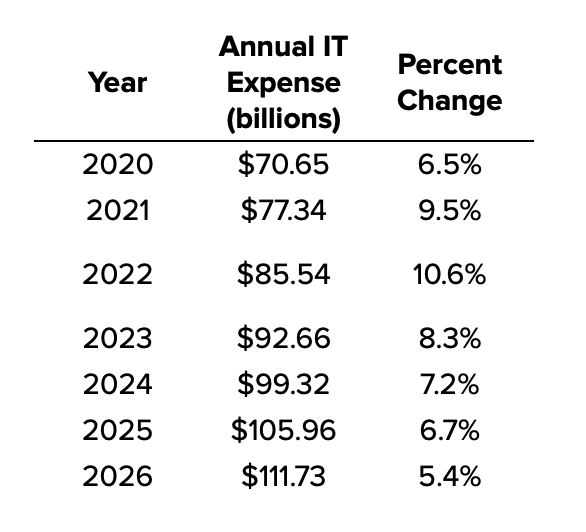

2022 Bank IT spending expected to increase faster than any previous year

Technology spend at U.S. banks will hit nearly $86 billion this year and grow to roughly $112 billion by 2026

U.S. Banks’ Annual IT Expenses (2020-2026)

Source: eMarketer, March 1, 2022

In its latest report, eMarketer found that despite the risk of a recession, bank technology budgets will reach new highs this year. Unlike in the past when banks cut costs in response to economic uncertainty, digital transformation has become a greater priority to stay competitive.

54% of customers use digital banking tools more now because of the pandemic, according to a 2021 JPMorgan study. Additionally, 99% of Gen Z and 98% of millennials use a mobile banking app.

Banks of all sizes, particularly mid-sized, smaller and neo banks, are allocating more resources to both customer-facing and back-end technology.

Technology Priorities - U.S. Banks (Dec. 2021)

Source: Cornerstone Advisors, Jan. 25, 2022

The share of total U.S. bank technology spending at the four largest banks will decrease to roughly 38% of market-wide tech spend by 2024, down from about 46% in 2017.

Mid-sized banks (e.g., PNC, U.S. Bank, KeyBank, Truist) are expected to increase their share of total spending to 12.6% in 2022.

The “other” category of banks (e.g., community banks, credit unions, neobanks) will make up 48.5% of total U.S. bank tech spending in 2024.